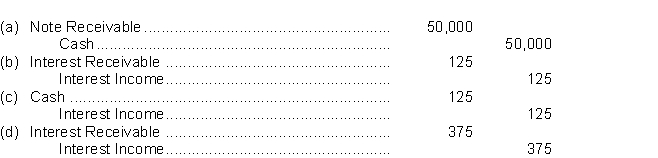

Tabby Inc.lends Siamese Ltd.$50,000 on April 1, accepting a 3-month, 3% interest note.Interest is due the first of each month, commencing May 1.Tabby Inc.prepares financial statements on April 30.What adjusting entry should be made before the financial statements can be prepared?

Correct Answer:

Verified

Q92: The two key parties to a promissory

Q93: The total interest owing on a $10,000,

Q94: When a company receives an interest-bearing note

Q95: The total interest owing on a $6,000,

Q96: Interest is usually associated with

A)accounts receivable.

B)notes receivable.

C)doubtful

Q98: Interest accrued on a note receivable is

A)credited

Q99: The total interest owing on a $10,000,

Q100: Wrong Corp.receives a $7,000, 6-month, 4% note

Q101: Use the following information for questions

The

Q102: A note receivable is honoured when

A)it is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents