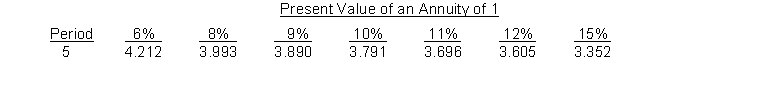

Santana Company is considering investing in a project that will cost $151,000 and have no salvage value at the end of its 5-year life. It is estimated that the project will generate annual cash inflows of $40,000 each year. The company requires a 9% rate of return and uses the following compound interest table:

Instructions

(a) Compute (1) the net present value and (2) the profitability index of the project.

(b) Compute the internal rate of return on this project.

(c) Should Santana invest in this project?

Correct Answer:

Verified

Q166: Yappy Company is considering a capital investment

Q167: Ace Corporation recently purchased a new machine

Q168: Cepeda Manufacturing Company is considering three new

Q169: Laramie Service Center just purchased an automobile

Q172: Under the net present value method, the

Q173: Shilling Corp. is thinking about opening a

Q174: Top Growth Farms, a farming cooperative, is

Q175: Savanna Company is considering two capital investment

Q176: Vista Company is considering two new projects,

Q209: The two discounted cash flow techniques used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents