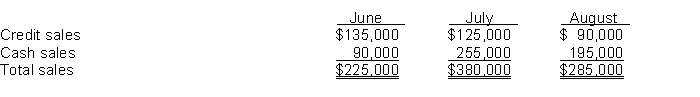

Cruises, Inc. has budgeted sales revenues as follows:

Past experience indicates that 60% of the credit sales will be collected in the month of sale and the remaining 40% will be collected in the following month. Purchases of inventory are all on credit and 50% is paid in the month of purchase and 50% in the month following purchase. Budgeted inventory purchases are:

June $300,000

July 240,000

August 105,000

Other cash disbursements budgeted: (a) selling and administrative expenses of $48,000 each month, (b) dividends of $103,000 will be paid in July, and (c) purchase of equipment in August for $30,000 cash.

The company wishes to maintain a minimum cash balance of $50,000 at the end of each month. The company borrows money from the bank at 6% interest if necessary to maintain the minimum cash balance. Borrowed money is repaid in months when there is an excess cash balance. The beginning cash balance on July 1 was $50,000. Assume that borrowed money in this case is for one month.

Instructions

Prepare a cash budget for the months of July and August. Prepare separate schedules for expected collections from customers and expected payments for purchases of inventory.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q186: Hagen Company's budgeted sales and direct materials

Q187: The Northeast Regional Division of Union Corp.

Q189: Minor Landscaping Company is preparing its budget

Q190: In September 2016, the budget committee of

Q193: The management of Ocean Industries estimates that

Q194: Effective budgeting is dependent on an _

Q194: Clay Co.'s projected sales are as follows:

Q197: The budget should have the support of

Q199: Many companies use _ budgets by dropping

Q212: A _ is responsible for coordinating the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents