Exhibit 18-1

On December 31, 2015, Fredericksburg, Inc. had no temporary differences that created deferred income taxes. On January 2, 2016, a new machine was purchased for $30,000. Straight-line depreciation over a four-year life no residual value) was used for financial accounting. Depreciation expense for tax purposes was $11,000 in 2016,

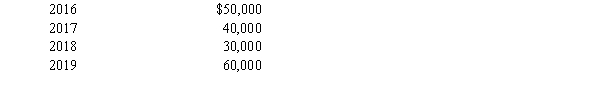

$9,000 in 2017, $6,000 in 2018, and $4,000 in 2015. In each year, the income tax rate was 20% and Fredericksburg had no other items that created differences between pretax financial income and taxable income. Fredericksburg reported the following pretax financial income for 2016 through 2019:

-Refer to Exhibit 18-1. The entry to record income taxes on December 31, 2017, would include a

A) debit to Deferred Tax Liability for $300.

B) credit to Income Taxes Payable for $8,000.

C) debit to Income Tax Expense for $7,700.

D) credit to Deferred Tax Liability for $300.

Correct Answer:

Verified

Q8: Which of the following is not a

Q17: The amount owed the IRS is recorded

Q19: In accounting for income taxes, percentage depletion

Q22: Which of the following statements regarding current

Q33: Differences between pretax financial income and taxable

Q35: In 2016, Waterford Corporation reported pretax financial

Q36: For the year ended December 31, 2016,

Q40: As of December 31, 2016, the Williamsburg

Q41: The Flintstone Company incurred the following expenses

Q42: Revenue from installment sales is recognized in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents