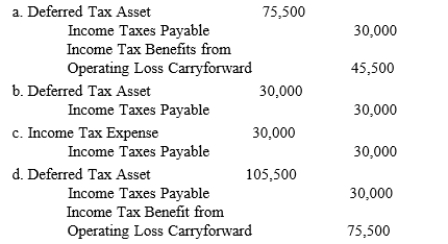

At the end of its first year of operations on December 31, 2016, the Brandon Company reported taxable income of $100,000 and had a pretax financial loss of $60,000. Differences between taxable income and pretax financial income included interest revenue received from municipal obligations of $20,000 and warranty expense accruals of

$180,000. Warranty expenses of $90,000 are expected to be paid in 2017 and $110,000 in 2018. The enacted income tax rates for 2016, 2017, and 2018 are 30%, 35%, and 40%, respectively. The journal entry to record income tax expense on December 31, 2016, would be

Correct Answer:

Verified

Q68: The Chance Company began operations in 2016

Q69: All of the following are income tax

Q70: Moore Company reported the following operating

Q70: Which one of the following transactions would

Q71: The presentation of the combination or "offsetting"

Q73: On December 31, 2015, Jefferson Lake, Inc.

Q74: Which of the following statements appropriately describe

Q75: Smyrna Company had financial and taxable incomes

Q76: The acceptable balance sheet classifications for deferred

Q77: Which one of the following would require

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents