Thorn Corporation has deductible and taxable temporary differences. At the beginning of 2016, its deferred tax asset was $12,000, and its deferred tax liability was $17,500. The company expects its future deductible amounts to be "deductible" in 2017 and its future taxable amount to be "taxable" in 2018. In 2015, Congress enacted revised tax

rates for future years as follows: 2016, 30%, 2017, 32%, and 2018, 35%. At the end of 2016 Thorn had income taxes payable of $23,500, and increase in deferred tax liability of $3,000, and an ending balance in its deferred tax asset of

$13,300.

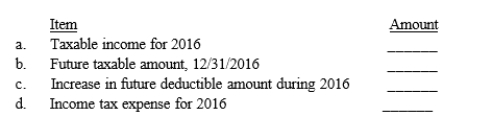

Required:

Assist Thorn in completing the schedule by filling in the blanks for items related to its income taxes for 2016. Show your computation.

Correct Answer:

Verified

b....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: Describe the process for determining deferred tax

Q89: Lakeland Corporation reported the following pretax and

Q90: At the end of its first year

Q91: Delmarva Company, during its first year of

Q92: Rice, Inc. began operations on January 1,

Q94: The following information relates to the Kill

Q95: Fairfax Company had a balance in Deferred

Q96: At the end of the current year,

Q97: At December 31, 2016, the Blue Agave

Q98: On December 31, 2016, the Town Hall

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents