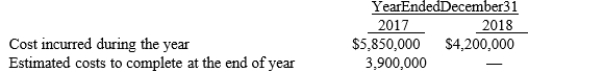

In 2017, Dygress Construction Co. began work on a contract for $16,500,000; it was completed in 2018. The following cost data pertain to this contract:  Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

Assuming the performance obligation is satisfied over time, what is the amount of gross profit to be recognized on the income statement for the year ended December 31, 2018?

A) $2,400,000

B) $2,695,000

C) $4,050,000

D) $6,450,000

Correct Answer:

Verified

Q66: What type of account is Construction in

Q67: A Provision for Loss on Contract is

Q68: Able Bakers sells cooking supplies and training

Q69: Noyes Construction Corporation contracted to construct a

Q70: On January 1, 2017, Carly Fashions Inc.

Q72: What type of account is Partial Billings?

A)

Q73: Exhibit 17-1

The following information relates to a

Q74: A contract asset

A) represents the seller's performance

Q75: Which of the following is not a

Q76: A construction project is expected to take

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents