The accountant for Suzanne Company made the following errors related to inventory in 2017:

1) The beginning inventory for 2017 was overstated by $1,375 due to an error in the physical count.

2) A $1,650 purchase of merchandise on credit in 2017 was not recorded or included in the ending inventory.

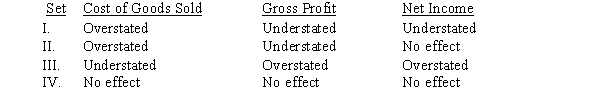

Assuming a periodic inventory system, how would Sue's cost of goods sold, gross profit, and net income be affected in 2017 by these errors?

A) Set I

B) Set II

C) Set III

D) Set IV

Correct Answer:

Verified

Q78: Stacie's Shoes uses the FIFO retail inventory

Q78: What is the effect on net income

Q80: Which of the following is not a

Q80: Which of the following variations of the

Q81: A purchase on credit is recorded twice

Q82: Barry Corp. reported 2016 net income of

Q84: The accountant for Lee Company made the

Q87: The dollar-value LIFO retail method

A) combines the

Q88: The accountant for the Daneen Company made

Q99: If in the current year a purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents