Exhibit 7-5

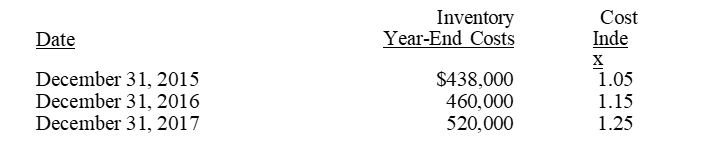

Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2015, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2017, using the dollar-value LIFO method would be

A) $422,000

B) $402,000

C) $426,000

D) $420,400

Correct Answer:

Verified

Q49: Which of the following is not a

Q57: Typically, the impact of the "LIFO reserve"

Q60: Which of the following cannot be used

Q63: A company uses a LIFO reserve because

Q65: IFRS does not allow the use of

Q66: Trip Corp. began business in 2015. On

Q69: Taylor Company changed its inventory cost flow

Q71: The term LIFO reserve refers to

A) a

Q72: Which one of the following is not

Q77: Which inventory cost flow assumption is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents