Logan Company has provided the following information:

1) Included in the physical count were inventory items billed to a customer FOB shipping point on December 31, 2016. The goods had a cost of $280 and had been billed at $400. The shipment was on Logan's loading dock waiting to be picked up by the trucking company.

2) Goods returned by customers and held pending inspection in the returned goods area on December 31, 2016, were not included in the physical count. On January 5, 2017, the goods costing $260 were inspected and returned to inventory. Credit memos totaling $380 were issued to the customers on the same date.

3) On January 3, 2017, a monthly freight bill in the amount of $170 was received. The bill specifically related to merchandise purchased in December 2016, 30% of which was still in inventory at December 31, 2016. The freight charges had not been recorded at December 31, 2016.

4) Goods were shipped out on consignment on December 15, 2016, and were recorded as a sale at the sales price of $550. The consignee has not yet sold these items. Goods are sold at a markup of 10% on cost. The goods were not included in inventory.

Required:

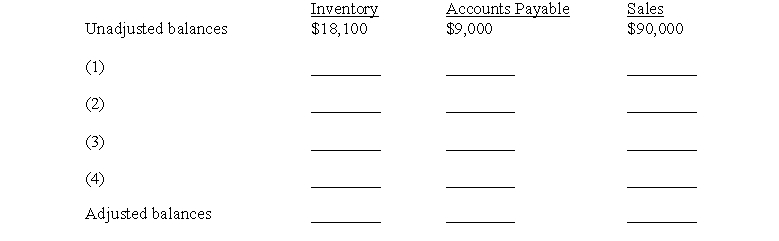

Logan's unadjusted balances on December 31, 2016, for Inventory, Accounts Payable, and Sales are provided in the three columns of the schedule below.

a. Complete the schedule to provide the correct adjusted balances at December 31, 2016.

b. Prepare the December 31, 2016, adjusting journal entry that Logan would prepare to record the freight charges described in item 3 above.

Correct Answer:

Verified

Q91: Trooper Company has provided the following inventory

Q92: Below is a list of key terms.

_

Q93: Revolution Hardware reported $475,000 of inventory on

Q94: At December 31, 2016, Jefferson, Inc. had

Q95: On October 17, Conrad Beauty Supplies bought

Q97: There are many differences between inventory cost

Q98: The following information was obtained from the

Q99: Richardson's Flower Depot uses FIFO for internal

Q100: Given the following information for Goode Company:

Q101: What are the cost flow assumptions available

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents