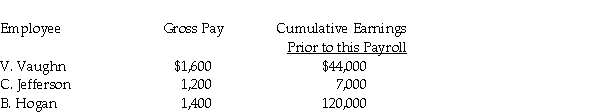

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Correct Answer:

Verified

Q32: FIT Payable has a credit normal balance.

Q33: Jefferson Tutoring had the following payroll information

Q34: Sweeney's Recording Studio payroll records show the

Q35: Mike's Door Service's payroll data for the

Q36: An employer must always use a calendar

Q38: Wages and Salaries Expense is:

A) equal to

Q39: What liability account is reduced when the

Q40: Mid-West Tutoring had the following payroll information

Q41: A calendar quarter is made up of:

A)

Q42: The following data applies to the July

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents