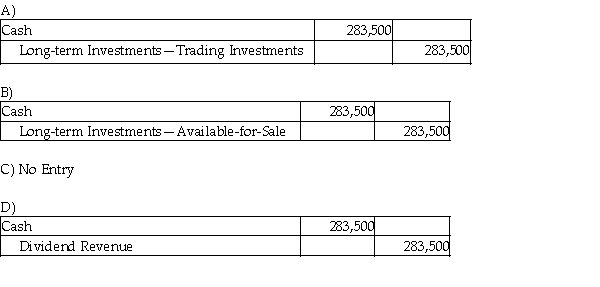

Ashbrook Services, Inc. acquired 126,000 shares of Gamma Metals, Inc. on January 1, 2017. Gamma declares a cash dividend of $2.25 per share on February 15, 2017 and pays the cash dividend on March 2, 2017. With the current investment, Ashbrook Services, Inc. holds 11% of Gamma's voting stock. Which of the following will be the correct journal entry for the day when the dividend payment is made (March 2, 2017)?

Correct Answer:

Verified

Q61: Dividends received from available-for-sale investments are recorded

Q62: Long Company owns a 2% investment in

Q66: Equity securities in which the investor owns

Q67: When a company receives a dividend payment

Q68: Maurice Corporation invested $100,000 to acquire 20,000

Q69: Eliasen, Inc. invests its excess cash in

Q71: Anthem Corporation has excess cash to invest

Q73: Griffin Corporation invested $136,000 to acquire 27,000

Q77: When a company uses idle cash to

Q78: Gain on Disposal of a trading investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents