The accounting records of Marcus Service Company include the following selected, unadjusted balances at June 30: Accounts Receivable, $2,700; Office Supplies, $1,800; Prepaid Rent, $3,600; Equipment, $15,000; Accumulated Depreciation - Equipment, $1,800; Salaries Payable, $0; Unearned Revenue, $2,400; Office Supplies Expense, $2,800; Rent Expense, $0; Salaries Expense, $15,000; Service Revenue, $40,500.

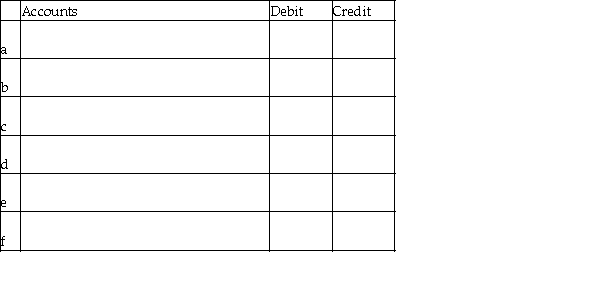

The following data developed for adjusting entries are as follows:

a. Service revenue accrued, $1,400

b. Unearned Revenue that has been earned, $800

c. Office Supplies on hand, $700

d. Salaries owed to employees, $1,800

e. One month of prepaid rent has expired, $1,200

f. Depreciation on equipment, $1,500

Journalize the adjusting entries. Omit explanations.

Correct Answer:

Verified

Q62: Dalton Delivery Service is hired on October

Q63: On January 1,Unearned Revenue of Grossman Company

Q66: Healthy Living,a diet magazine,collected $240,000 in subscription

Q68: On January 1,2015,the Accounts Receivable of Linda

Q74: Pluto Promotions sells tickets in advance for

Q76: Get in Shape,a healthy living magazine,collected $528,000

Q101: In the case of deferred revenue,the adjusting

Q105: In the case of deferred revenue,the cash

Q110: Unearned Revenue is classified as a(n)_ account.

A)

Q157: An adjusting entry that debits Accounts Receivable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents