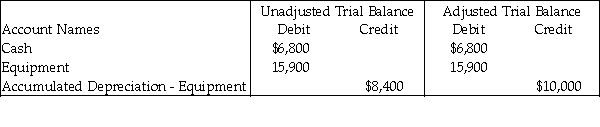

The following extract was taken from the worksheet of Kelly Bakers for the year 2016. Kelly Bakers

Worksheet

December 31, 2016  For the above information, determine the amount of Depreciation Expense for the equipment used in the business.

For the above information, determine the amount of Depreciation Expense for the equipment used in the business.

A) $10,000

B) $3,200

C) $5,900

D) $1,600

Correct Answer:

Verified

Q164: Sierra Event Planning Services records deferred expenses

Q171: The partial worksheet of Ruth Furniture is

Q174: Williams Enterprises prepaid six months of office

Q175: On September 1,Capitol Maintenance Company contracted to

Q176: Wentlent Services Company records deferred expenses as

Q178: On December 15,Duncan Services Company collected revenue

Q203: An internal document that helps summarize data

Q213: The worksheet is a useful step in

Q215: Deferred revenues are assets because the business

Q216: Deferred expenses are also called prepaid expenses.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents