Consider the following information:

1. On November 1, 2017, a U.S. firm contracts to sell equipment (with an asking price of 500,000 pesos) in Mexico. The firm will take delivery and will pay for the equipment on February 1, 2018.

2. On November 1, 2017, the company enters into a forward contract to sell 500,000 pesos for $0.0948 on February 1, 2018.

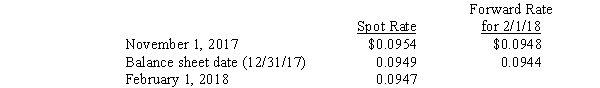

3. Spot rates and the forward rates for February 1, 2018, settlement were as follows (dollars per peso):  4. On February 1, the equipment was sold for 500,000 pesos. The cost of the equipment was $20,000.

4. On February 1, the equipment was sold for 500,000 pesos. The cost of the equipment was $20,000.

Required:

Prepare all journal entries needed on November 1, December 31, and February 1 to account for the forward contract, the firm commitment, and the transaction to sell the equipment.

Correct Answer:

Verified

Q20: A transaction gain is recorded when there

Q21: On April 1, 2017, Manatee Company entered

Q22: On October 1, 2016, Kill Company shipped

Q23: Imperial Corp., a U.S. corporation, entered into

Q24: On October 1, 2016, Philly Company purchased

Q26: On July 15, Pinta, Inc. purchased 88,500,000

Q27: On December 1, 2016, Dorn Corporation agreed

Q28: On April 1, 2017, Manatee Company entered

Q29: On November 1, 2017, Cone Company sold

Q30: On November 1, 2017, National Company sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents