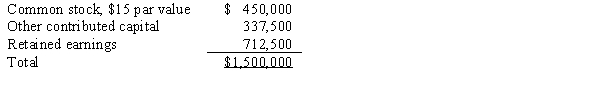

Parr Company owned 24,000 of the 30,000 outstanding common shares of Solomon Company on January 1, 2016. Parr's shares were purchased at book value when the fair values of Solomon's assets and liabilities were equal to their book values. The stockholders' equity of Solomon Company on January 1, 2016, consisted of the following:  Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2016. If all 7,500 shares were sold to noncontrolling stockholders, the workpaper adjustment needed each time a workpaper is prepared should increase (decrease) the Investment in Solomon Company by:

Solomon Company sold 7,500 additional shares of common stock for $90 per share on January 2, 2016. If all 7,500 shares were sold to noncontrolling stockholders, the workpaper adjustment needed each time a workpaper is prepared should increase (decrease) the Investment in Solomon Company by:

A) ($140,625) .

B) $140,625.

C) ($112,500) .

D) $192,000.

Correct Answer:

Verified

Q1: If a portion of an investment is

Q3: On January 1, 2012, Parent Company purchased

Q4: Which one of the following statements regarding

Q5: On January 1, 2012, Pharma Company purchased

Q6: Under the partial equity method, the workpaper

Q7: When the parent company sells a portion

Q8: P Corporation purchased an 80% interest in

Q9: Parr Company owned 24,000 of the 30,000

Q10: If a subsidiary issues new shares of

Q11: On January 1, 2012, Pine Corporation purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents