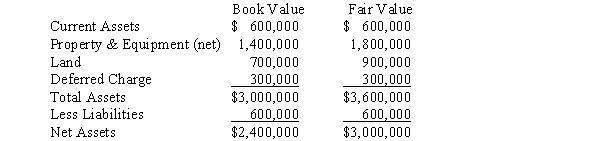

Plain Corporation acquired a 75% interest in Swampy Company on January 1, 2016, for $2,000,000. The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:  The property and equipment had a remaining life of 6 years on January 1, 2016, and the deferred charge was being amortized over a period of 5 years from that date. Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2016. Plain Company records its investment in Swampy Company using the cost method.

The property and equipment had a remaining life of 6 years on January 1, 2016, and the deferred charge was being amortized over a period of 5 years from that date. Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2016. Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare, in general journal form, the December 31, 2016, workpaper entries necessary to:

A. Eliminate the investment account.

B. Allocate and amortize the difference between implied and book value.

Correct Answer:

Verified

Q24: Pruin Corporation acquired all of the voting

Q25: Push down accounting is an accounting method

Q26: When the value implied by the acquisition

Q27: Phillips Company purchased a 90% interest in

Q28: On January 1, 2016, Phoenix Company acquired

Q30: Primer Company acquired an 80% interest in

Q31: Pullman Corporation acquired a 90% interest in

Q32: On January 1, 2016, Poole Company purchased

Q33: On January 1, 2016, Poole Company purchased

Q34: On January 1, 2016, Pilsner Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents