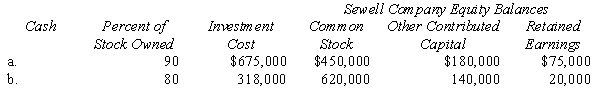

Prepare in general journal form the workpaper entries to eliminate Porter Company's investment in Sewell Company in the preparation of a consolidated balance sheet at the date of acquisition for each of the following independent cases:  Any difference between book value of net assets acquired and the value implied by the purchase price relates to subsidiary property, plant, and equipment except for case (b). In case (b) assume that all book values and fair values are the same.

Any difference between book value of net assets acquired and the value implied by the purchase price relates to subsidiary property, plant, and equipment except for case (b). In case (b) assume that all book values and fair values are the same.

Correct Answer:

Verified

Q18: Under the economic entity concept, consolidated financial

Q19: On January 1, 2016, Pell Company and

Q20: The Difference between Implied and Book Value

Q21: On January 1, 2016, Prima Company issued

Q22: On January 1, 2016, Pent Company and

Q24: P Corporation paid $420,000 for 70% of

Q25: If an entity is not considered a

Q26: On December 31, 2016, Priestly Company purchased

Q27: On January 2, 2016, Pope Company acquired

Q28: P Company acquired 54,000 shares of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents