On January 1, 2012, Keller Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2013, more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Utilities Expense. Keller Company uses the straight-line method of depreciation.

Instructions

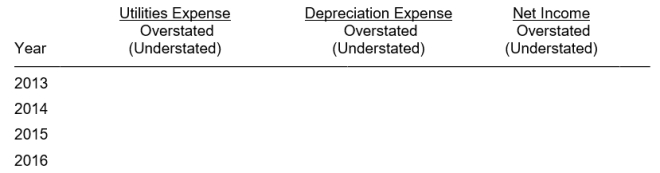

Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Correct Answer:

Verified

Q209: Plant assets are ordinarily presented in the

Q217: A company purchased office equipment for $30,000

Q218: A factory machine was purchased for $70,000

Q219: Vickers Company uses the units-of-activity method in

Q220: On October 1, 2014, Hess Company places

Q222: Equipment was acquired on January 1, 2010,

Q223: Using the following data for Hayes, Inc.,

Q224: On March 1, 2014, Geoffrey Company acquired

Q225: Revson Corporation purchased land adjacent to its

Q226: Indicate whether each of the following expenditures

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents