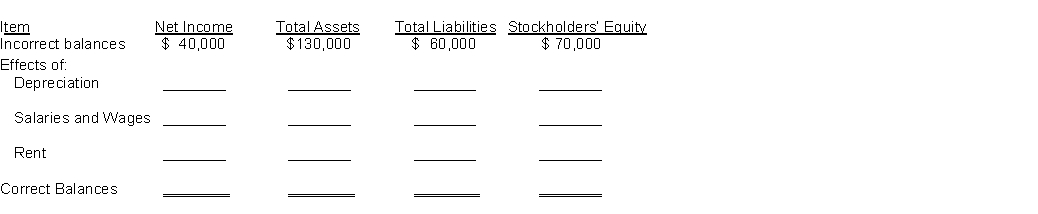

On December 31, 2014, Çolski Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $40,000. The balance sheet showed total assets, $130,000; total liabilities, $60,000; and stockholders' equity, $70,000.

The data for the three adjusting entries were:

(1) Depreciation of $9,000 was not recorded on equipment.

(2) Salaries and Wages amounting to $10,000 for the last two days in December were not paid and not recorded. The next payroll will be in January.

(3) Rent of $8,000 was paid for two months in advance on December 1. The entire amount was debited to Prepaid Rent when paid.

Instructions:

Complete the following tabulation to correct the financial statement amounts shown (indicate deductions with parentheses):

Correct Answer:

Verified

Q241: A review of the ledger of

Q242: On January 1, the Biddle & Biddle,

Q243: Better Publications, sold annual subscriptions to their

Q244: A company using the cash basis

Q245: On February 1, the Acts Tax Service

Q247: The 2014 income statement for Moring

Q248: Prepare adjusting entries for the following transactions.

Q249: The adjusted trial balance of Warbocks Corporation

Q250: Double-entry Accounting Services begin operations on

Q251: The Downtown Company accumulates the following adjustment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents