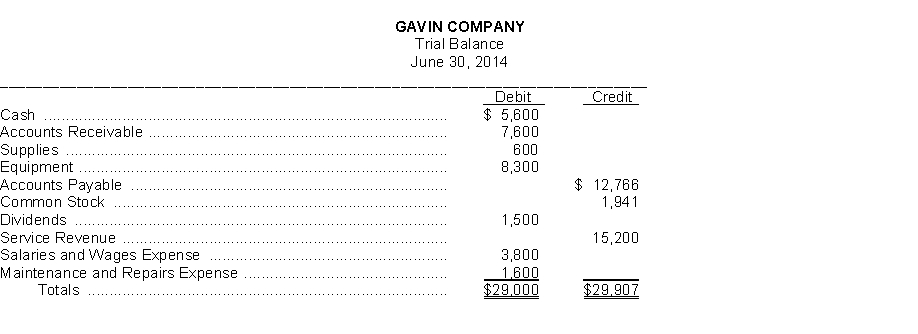

The trial balance of the Gavin Company shown below does not balance.  An examination of the ledger and journal reveals the following errors:

An examination of the ledger and journal reveals the following errors:

1. Each of the above listed accounts has a normal balance per the general ledger.

2. Cash of $350 received from a customer on account was debited to Cash $530 and credited to Accounts Receivable $530.

3. Dividends of $300 paid to stockholders were posted as a credit to Dividends, $300, and a credit to Cash $300.

4. Salaries and Wages Expense of $300 was omitted from the trial balance.

5. The purchase of equipment on account for $700 was recorded as a debit to Maintenance and Repairs Expense and a credit to Accounts Payable for $700.

6. Services were performed on account for a customer, $510, for which Accounts Receivable was debited $510 and Service Revenue was credited $51.

7. A payment on account for $215 was credited to Cash for $215 and credited to Accounts Payable for $251.

Instructions

Prepare a correct trial balance.

Correct Answer:

Verified

Q182: The basic steps in the recording process

Q185: Why is the Dividends account increased by

Q188: _ _ and _ have debit normal

Q190: A sales slip a check and a

Q252: The act of entering an amount on

Q253: Sue Sloan and Associates is a

Q254: Eight transactions are recorded in the following

Q255: Some of the following errors would cause

Q259: An _ is an individual accounting record

Q261: Under IFRS, the trial balance

A) follow the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents