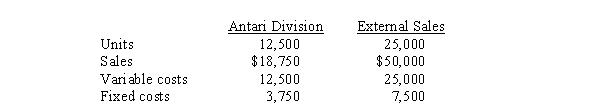

The Jupiter Division of Space, Inc. produces dilithium crystals. One-third of its output is sold to the Antari Division, and the remainder is sold externally. Jupiter's estimated sales and cost data for the coming year are:  Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will be

Assume that Jupiter cannot sell any additional crystals externally. If the Antari Division has an opportunity to buy from an outside supplier at $1.40 per crystal and Jupiter refuses to meet this price, the company as a whole will be

A) $1,250 better off

B) $3,750 worse off

C) $6,250 better off

D) $5,000 worse off

Correct Answer:

Verified

Q1: Division A of a firm produces a

Q13: THN Corporation reported operating income of $30,000,

Q16: In a dual-rate transfer pricing system, the

Q18: Transfer pricing policies can affect a company's

Q24: Use the following information for the next

Q27: Use the following information for the next

Q30: Use the following information for the next

Q31: Use the following information for the next

Q33: If a product has an external market

Q34: Use the following information for the next

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents