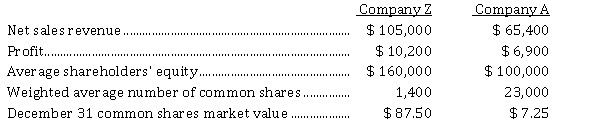

Certain information from the financial records of Companies Z and A are presented below for the year ended December 31. The two companies are in the same industry.  Included in the shareholders' equity of Company Z is $ 75,000 of cumulative preferred shares with a 5% annual dividend entitlement ($ 3,750 per year).

Included in the shareholders' equity of Company Z is $ 75,000 of cumulative preferred shares with a 5% annual dividend entitlement ($ 3,750 per year).

Instructions

a) Calculate the following for each company:

(i) Profit margin

(ii) Return on equity to common shareholders

b) Calculate the following for each company:

(i) Earnings per share

(ii) Price-earnings ratio

c) Based on the ratios calculated in part

c), which company's investors appear to be more optimistic about the future of the company? Explain your answer by reference to the ratios calculated.

Correct Answer:

Verified

Company Z ($ 10,20...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q162: The following information was taken from the

Q163: The balance sheets and income statements for

Q164: Selected information from the comparative financial statements

Q165: The balance sheet for Finley Corporation at

Q166: The following information is based on the

Q168: The following ratios have been calculated

Q169: The income statement for Woodford Corporation for

Q170: Winnipeg Corporation has issued common shares

Q171: The following selected ratios are available for

Q172: The following information for 2021 is provided

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents