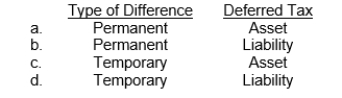

A company uses the equity method to account for an investment.This would result in what type of difference and in what type of deferred income tax?

Correct Answer:

Verified

Q7: A deferred tax liability represents the increase

Q19: Companies classify the balances in the deferred

Q21: Machinery was acquired at the beginning of

Q22: Taxable income of a corporation

A)differs from accounting

Q23: A temporary difference arises when a revenue

Q26: Which of the following are temporary differences

Q28: Under IFRS

A)"probable" is defined as a level

Q29: An assumption inherent in a company's IFRS

Q30: Which of the following differences would result

Q37: The deferred tax expense is the

A) increase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents