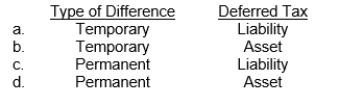

A company records an unrealized loss on short-term securities.This would result in what type of difference and in what type of deferred income tax?

Correct Answer:

Verified

Q23: A major distinction between temporary and permanent

Q28: Under IFRS

A)"probable" is defined as a level

Q29: An assumption inherent in a company's IFRS

Q30: 30.At the December 31, 2015 statement

Q31: Each of the following is determined according

Q35: Which of the following statements is correct

Q35: Which of the following temporary differences results

Q36: An example of a permanent difference is

A)fines

Q37: Which of the following will not result

Q40: Assuming a 40% statutory tax rate applies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents