Jerry recently was offered a position with a major accounting firm.The firm offered Jerry either a signing bonus of $23,000 payable on the first day of work or a signing bonus of $26,000 payable after one year of employment.Assuming that the relevant interest rate is 10%, which option should Jerry choose?

A) The options are equivalent.

B) Insufficient information to determine.

C) The signing bonus of $23,000 payable on the first day of work.

D) The signing bonus of $26,000 payable after one year of employment.

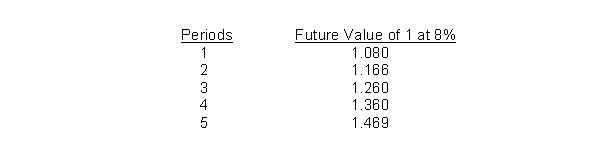

Items 56 through 58 apply to the appropriate use of interest tables.Given below are the future value factors for 1 at 8% for one to five periods.Each of the items 56 to 58 is based on 8% interest compounded annually.

Correct Answer:

Verified

Q27: A series of equal receipts at equal

Q33: Present value is

A) the value now of

Q51: Given below are the present value factors

Q52: If $4,000 is put in a savings

Q53: Which of the following is true?

A) Rents

Q55: On May 1, 2015, a company purchased

Q56: What is the primary difference between an

Q57: What is the relationship between the future

Q58: Given below are the present value factors

Q58: On December 1, 2015, Richards Company sold

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents