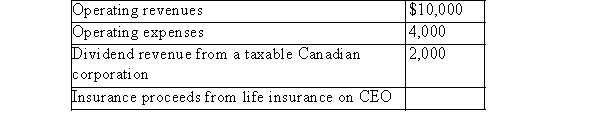

XYZ Ltd., a taxable Canadian corporation, reported the following revenues and expenses in these amounts for both taxes and financial reporting (the tax rate is 40%) .  What is income tax expense for the year?

What is income tax expense for the year?

A) $3,600

B) $4,400

C) $2,400

D) $4,000

Correct Answer:

Verified

Q15: Choose the best statement with respect to

Q16: JMR Corporation suffered a loss in 2013.As

Q17: VB Corporation reported a net loss of

Q18: The maximum number of years a tax

Q19: The following information for KEG Corporation is

Q21: JG Ltd.provided you with the following information:

Q22: Which of the following statements with respect

Q23: A company that has sustained a tax

Q24: XYZ Inc.is a publicly traded company.At the

Q25: JMR Corp.sustained taxable income in 2011 of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents