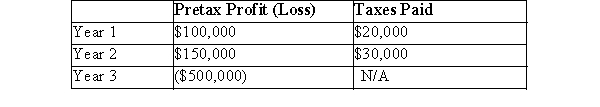

Loser Inc.reported the following pretax amounts for each of the last three years:  Additional Information:

Additional Information:

The tax rate in Year 3 and prior was 20%.The tax rate for Year 4 and beyond will be 25% and is known by Loser in Year 3.

At the start of Year 3, Loser had a DTL balance of $50,000 due to the excess of CCA over depreciation taken by Loser up to that date.During Year 3, the company took $110,000 more CCA than depreciation.

During Year 3 the company bought a parcel of land, which it had to write down during the same period due to environmental contamination rendering a portion of the land non-usable.The amount of the write-down was $40,000.

Loser Inc.has a policy of carrying tax losses back as far as possible and carrying forward the balance (the more-likely-than-not)criteria has been met for any tax loss carry-forwards.

Loser Inc.currently has no capital gains, but it expects to have enough capital gains in the future against which it will be able to use any capital loss carry forwards.

The company uses a single account for all of its deferred tax asset/liability balances.

Required:

Prepare all the journal entries and show all Deferred Tax Asset and/or Liability balances as at the end of Year 3.

Correct Answer:

Verified

Q88: AG's taxable income for the first five

Q89: KAR's taxable income for the first five

Q90: JG Ltd.has been in business for five

Q91: How does the existence of a loss

Q92: Financial information related to Unip Limited's ("UL")2013

Q93: KER Corp.incurred a loss in 20x15 after

Q94: How should a deferred income tax benefit

Q96: What options are open to a company

Q97: EGR Ltd.has been in business for five

Q98: There is some question as to whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents