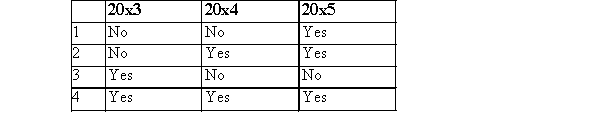

Compensatory stock options were granted to executives on January 1, 20x3, with a measurement date of June 30, 20x4, for services to be rendered during 20x3, 20x4, and 20x5.The excess of the market value of the shares over the option price at the measurement date was reasonably estimable at the date of grant.The stock option was exercised on October 31, 20x5.Compensation expense should be recognized in the income statement in which of the following years?

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q32: All of the following are examples of

Q33: General characteristics of convertible bonds that will

Q34: A stock option plan is a compensatory

Q35: For each type of financial instrument, the

Q36: Primary securities that have both debt and

Q38: A company issues a convertible bond.Management can

Q39: If a company issues debt that is

Q40: On January 1, Year 1, ABC Inc.,

Q41: The tax status of a financial instrument

Q42: When interest is repayable to investors at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents