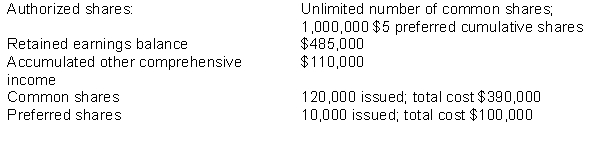

On January 1, 2014, the following information appears in the records of Boultin Holdings Inc.:  During the year, the company had the following transactions:

During the year, the company had the following transactions:

Mar 31 Declared cash dividends on common shares of $0.50 per share; payable to shareholders of record on April 10, and payable on April 25.

Jun 30 Declared the entire annual dividend required on preferred shares; payable to shareholders of record on July 15, and payable on July 31.

Sep 15 Declared a 10% stock dividend to shareholders of record on October 5, and distributable on October 15.

All dividends were paid or distributed on the due date.

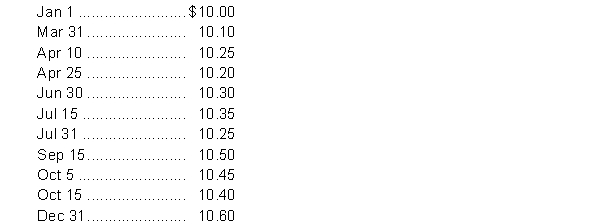

Market price of Boultin's common shares at various dates was as follows:  At December 31, 2014 the accounting records indicate that Boultin's profit for 2014 was $350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $28,000.

At December 31, 2014 the accounting records indicate that Boultin's profit for 2014 was $350,000 and other comprehensive income, consisting of a gain on fair value adjustments on equity investments was $28,000.

Instructions

a. Journalize the dividend transactions.

b. Prepare the statement of changes in shareholders equity for the year ended December 31, 2014.

c. Prepare the shareholders' equity section of Boultin's balance sheet at December 31, 2014.

Correct Answer:

Verified

Q114: For the year ended December 31, 2014,

Q115: The following is information taken from the

Q116: On January 1, 2013, Davin Corporation had

Q117: Oswala Inc. had the following balances in

Q118: Westcock Shipbuilding Ltd. has a December 31

Q120: The following information is available for a

Q121: At January 1, 2014, Morrisey Corporation had

Q122: The market price of Sanji's Paper Inc.'s

Q123: The following information is taken from the

Q124: At July 1, 2013, Peters Corporation had

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents