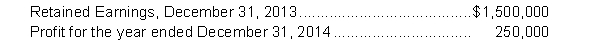

The following information is available for Reynolds Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2014, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on a machine in 2012 and 2013 using the double diminishing-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effect of the error on prior years was $9,000. Depreciation was calculated by the straight-line method in 2014. Reynolds' average tax rate is 22%. During 2014, Reynolds declared and paid cash dividends of $80,000.

Instructions

a. Calculate the impact on retained earnings.

b. Prepare the statement of retained earnings for 2014.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: At December 31, 2014, Sookie Limited has

Q127: Ahab Fisheries Inc. has authorized share capital

Q128: Groom Corporation had profit of $415,000 for

Q129: During 2014, the following independent events occurred

Q130: Connolly Corporation had the following events during

Q131: The following accounts appear in the ledger

Q132: At January 1, 2014, Stevenson Inc. had

Q133: On January 1, 2014, Chu Corporation had

Q134: Saha Company had profit of $1,020,000 for

Q136: Match the items below by entering the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents