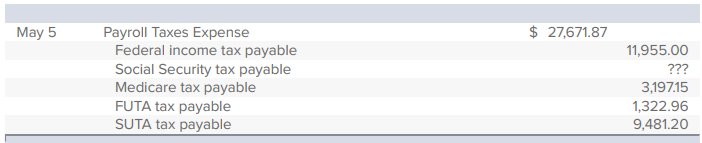

Didier and Sons had the following employer's share payroll tax general journal entry for the May 5 pay date:

What is the amount of the Social Security tax payable?

A) $1,582.39

B) $2,572.59

C) $1,715.56

D) $1,875.98

Correct Answer:

Verified

Q21: What are the General Journal entries that

Q22: McHale Enterprises has the following incomplete General

Q23: In which order are transactions listed in

Q24: Which of the following is an example

Q25: Kierofree Air Tours has the following payroll

Q27: When a firm has wages earned but

Q28: Rushing River Boats has the following data

Q29: In the following payroll transaction, what is

Q30: Dooley Publishing has the following payroll data

Q31: Which of the following is an example

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents