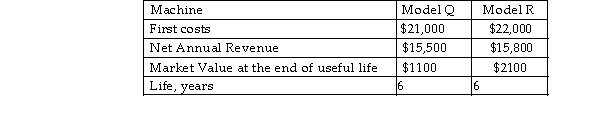

A construction company has an effective income tax rate of 38%. The company must purchase one of the following two models of tower cranes for its new project. The

after- tax MARR is 12% per year. Select a crane on the basis of present worth of the EVA estimates using MACRS with a 5- year recovery period.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: A petroleum refining and recovery service company,

Q17: A low- cost airline operating in South

Q18: A machine used in the manufacture of

Q19: Seminole Lighting, a specialty lamps and specialty

Q19: An uninterruptible power system used in a

Q20: Mountaineer Transportation, Inc. had the following information

Q23: An piece of automated assembly equipment has

Q24: A logistics company is deciding between two

Q26: Bulldog Shipping, Inc. has purchased new cargo

Q28: Aggie Research Laboratory purchased a new High

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents