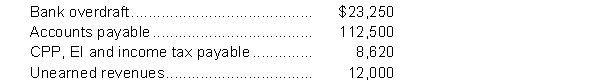

Juliana Limited has an October 31 year end. On October 1, 2020 Juliana had the following current liabilities listed on its books:  During October 2020 Juliana engaged in the following transactions:

During October 2020 Juliana engaged in the following transactions:

Oct 1 Negotiated a $50,000 line of credit with their bank to replace the bank overdraft.

Oct 5 Sold goods worth $30,000 on which they had previously received a $12,000 deposit. The balance is due in 30 days.

Oct 12 Bought $20,000 of inventory on credit, terms of 30 days.

Oct 15 Paid amounts due the Government of Canada for the payroll amounts outstanding from September 30.

Oct 20 Paid $87,000 owing to a supplier.

Oct 21 Received $5,000 from a client for work that will be performed in January 2018.

Oct 21 Sold $56,000 of goods half for cash, half on credit.

Oct 22 Made a $10,000 payment on the line of credit.

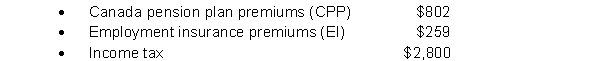

Oct 30 Paid the monthly payroll amounts to employees. The gross payroll was $16,200. Amounts withheld from the employees' cheques were as follows:  At this time, the company also recorded their liability for amounts due to the government for CPP and EI.

At this time, the company also recorded their liability for amounts due to the government for CPP and EI.

Oct 31 Declared $5,000 of dividends payable next year.

Instructions

a) Prepare all of the journal entries required as a result of the above transactions.

b) Prepare the current liabilities section of the statement of financial position at October 31, 2020.

Correct Answer:

Verified

Q45: Miller Manufacturing has a two-week payroll of

Q47: The following instalment payment schedule is for

Q47: An employee earns $1,500 a week and

Q48: During the current month, the employees

Q50: In order for an item to be

Q53: Which of the following liabilities results from

Q54: Spring Water Corporation has the following selected

Q55: Dividends Payable is the most common type

Q55: Below is the financial data pertaining to

Q56: You have just started your new position

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents