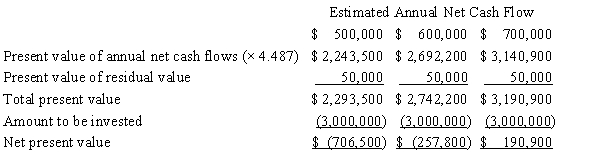

Xander Inc. has prepared the following sensitivity analysis:  In addition, it has assigned the following likelihoods to the three possible annual net cash flows: $500,000, 70%; $600,000, 20%; and $700,000, 10%. Based on an expected value analysis, which of the following statements is accurate?

In addition, it has assigned the following likelihoods to the three possible annual net cash flows: $500,000, 70%; $600,000, 20%; and $700,000, 10%. Based on an expected value analysis, which of the following statements is accurate?

A) The expected value of the annual net cash flow is $540,000, and the project should be rejected.

B) The expected value of the annual net cash flow is $540,000, and the project should be accepted.

C) The expected value of the annual net cash flow is $660,000, and the project should be rejected.

D) The expected value of the annual net cash flow is $660,000, and the project should be accepted.

Correct Answer:

Verified

Q123: Which of the following is not considered

Q143: In capital rationing, alternative proposals that survive

Q144: Match each definition that follows with the

Q147: In capital rationing, alternative proposals are initially

Q150: Match each of the methods that follow

Q151: Match each definition that follows with the

Q154: Match each definition that follows with the

Q158: Match each of the methods that follow

Q159: Match each definition that follows with the

Q160: Match each definition that follows with the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents