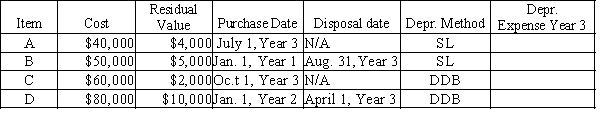

For each of the following fixed assets, determine the depreciation expense for Year 3:

Disposal date is N/A if asset is still in use.Method: SL = straight line; DDB = double declining balance

Assume the estimated life is 5 years for each asset.

Correct Answer:

Verified

Q182: The double-declining-balance rate for calculating depreciation expense

Q190: Equipment was purchased on January 5, year

Q195: Convert each of the following estimates of

Q196: Machinery is purchased on July 1 of

Q196: Golden Sales has bought $135,000 in fixed

Q199: Determine the depreciation, for the year of

Q199: Prior to adjustment at the end of

Q202: Computer equipment (office equipment) purchased 6 1/2

Q203: Identify the following as a fixed asset

Q215: Solare Company acquired mineral rights for $60,000,000.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents