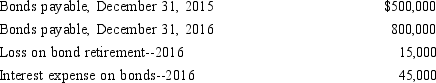

Below is information for Toronto Imports Corp. for 2015 and 2016:  At the end of 2016, Toronto issued bonds at par value for $800,000 cash. The proceeds from these bonds were used to retire the $500,000 bond issue outstanding at the end of 2015 before their maturity date. All interest expense was paid in cash during 2016.

At the end of 2016, Toronto issued bonds at par value for $800,000 cash. The proceeds from these bonds were used to retire the $500,000 bond issue outstanding at the end of 2015 before their maturity date. All interest expense was paid in cash during 2016.

The following statements describe how Toronto reported the cash flow effects of the items described above on its 2016 statement of cash flows. The indirect method is used to prepare the operating activities section. Which of the following has been reported incorrectly by Toronto?

A) Proceeds of $800,000 from the issuance of bonds were reported as a cash inflow in the financing activities section.

B) The loss on bond retirement of $15,000 was added to net income in the operating activities section.

C) Payments of $560,000 were reported as a cash outflow in the investing activities section.

D) Interest expense of $45,000 was not reported separately because it is included in net income in the operating activities section.

Correct Answer:

Verified

Q24: Which of the following should be classified

Q25: Upon review of Jan's Lakeside Resort statement

Q29: Upon review of Jerry's Canoe Gallery statement

Q30: Eduardo's Texas Cantina had the following results

Q31: Presented below is the operating activities section

Q66: Which balance sheet accounts are most affected

Q66: A mortgage incurred in exchange for an

Q68: Which method of preparing the operating activities

Q78: Which balance sheet accounts are most affected

Q78: Which method of preparing the operating activities

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents