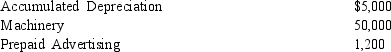

Marcus Roberts operates a small retail establishment. The following unadjusted amounts were taken from Roberts' accounting records at December 31, 2015:

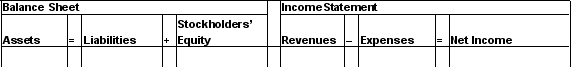

Determine the effect on the accounting equation of the adjusting entries at December 31, 2015, for each of the transactions that follow:

Determine the effect on the accounting equation of the adjusting entries at December 31, 2015, for each of the transactions that follow:

A. The advertising costs are for television commercials to be aired equally throughout December, 2015, and January and February, 2016.

B. The machinery had an original cost of $50,000 and was purchased during 2010. The estimated useful life is 6 years with an estimated salvage value equal to $8,000. Roberts uses the straight-line method of depreciation.

Correct Answer:

Verified

Q166: Motor Repair Shop uses the accrual basis

Q167: Frannie's Dance Studio accounting records reflect the

Q169: The Diva Design Group was organized on

Q170: Given below are the accounts from Surf

Q172: Refer to the consolidated statements of income

Q173: At the end of 2015, the unadjusted

Q174: Fennel Flooring purchased office supplies for its

Q175: Calzone, Inc. signs a 9% 4-month $50,000

Q176: Lowen Homes, Inc. pays its sales personnel

Q195: Scenic View Foods Corporation

The following consolidated statements

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents