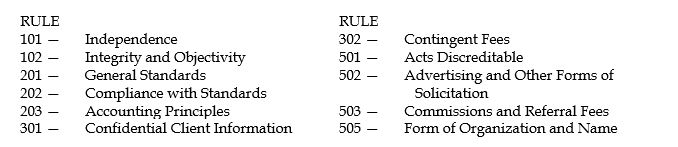

For each of the following actions by a member CPA, indicate (1) the rule of conduct that is applicable and (2) whether the actions does (yes) or does not (no) violate the rule. You may identify the rule by number on your answer sheet. Your selections can be made from the following list:  1.Discriminates in employment.

1.Discriminates in employment.

2.Makes recommendations but not the decisions in an MCS engagement for a nonpublic client.

3.Permits a non-CPA to be the chairman of the board of a CPA firm organized as a professional corporation.

4.Fails to make inquiries in a review of interim financial information.

5.Accepts a commission from a vendor, with the permission of the audit client, for

recommending the vendor's product.

6.Indicates that he will perform the audit of a city's united fund charity for a nominal fee.

7.Transfers working papers, with the client's permission, to the client's new auditors.

8.Subordinates his judgment in favor of the client in tax practice when there is little support for the client's position.

9.Indicates the number of partners, CPAs and offices in his or her firm in an advertisement.

10.States that the fee in a tax case will be based on the amount of tax saving realized.

11.Fails to conform to a recently issued SAS, which has an immaterial effect on the financial statements.

12.A personnel manager in the office doing the audit of a client has a financial interest in the client.

13.Fails to adequately plan and supervise an MCS engagement.

14.Agrees to serve as an honorary director of a charitable foundation.

15.Knowingly misrepresents facts in an engagement.

Correct Answer:

Verified

Q60: Which section of the AICPA's Rules of

Q61: Under the "Joint Ethics Enforcement Program" (JEEP),

Q62: The Joint Trial Board may take which

Q63: The CPA Vision Project identified five core

Q64: Rule 503 in the AICPA's Code of

Q66: The maximum sanction that the AICPA can

Q67: Which of the following ethical principles is

Q68: The FTC's 1990 Order to the AICPA

Q69: Interpretation 505-3 requires all of the following

Q70: Trial board hearings are generally held by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents