SCENARIO 13-7

An investment specialist claims that if one holds a portfolio that moves in the opposite direction to the market index like the S&P 500,then it is possible to reduce the variability of the portfolio's return.In other words,one can create a portfolio with positive returns but less exposure to risk.

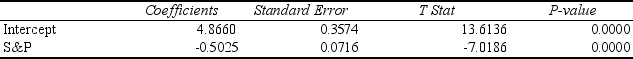

A sample of 26 years of S&P 500 index and a portfolio consisting of stocks of private prisons,which are believed to be negatively related to the S&P 500 index,is collected.A regression analysis was performed by regressing the returns of the prison stocks portfolio (Y)on the returns of S&P 500 index

(X)to prove that the prison stocks portfolio is negatively related to the S&P 500 index at a 5% level of significance.The results are given in the following EXCEL output.

-Referring to Scenario 13-7,to test whether the prison stocks portfolio is negatively related to the S&P 500 index,the p-value of the associated test statistic is

Correct Answer:

Verified

Q100: The Durbin-Watson D statistic is used to

Q101: If you wanted to find out

Q102: What do we mean when we say

Q103: SCENARIO 13-7

An investment specialist claims that

Q104: SCENARIO 13-9

It is believed that, the average

Q106: SCENARIO 13-9

It is believed that, the average

Q107: The sample correlation coefficient between X

Q108: The sample correlation coefficient between X

Q109: The strength of the linear relationship between

Q110: Testing for the existence of correlation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents