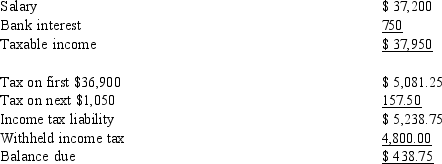

Barry has prepared the following 2014 income tax estimate for his sister, Sylvia. Sylvia is single, age 32, and has no children. Sylvia is an employee of General Motors and rents an apartment. Her only investment is a savings bank account.  Identify the errors, if any, in Barry's income tax estimate. Additional calculations are not required.

Identify the errors, if any, in Barry's income tax estimate. Additional calculations are not required.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Which of the following statements is/are correct?

I.There

Q93: Adjusted gross income (AGI)

I.is used to provide

Q99: Betty hires Sam to prepare her federal

Q105: Pedro, a cash basis taxpayer, would like

Q106: Which of the following taxpayers used tax

Q107: In December 2014, Arnold is considering one

Q136: Winfield Corporation recently purchased equipment that qualifies

Q142: Joe Bob operates a gas station/grocery store

Q147: Ed travels from one construction site to

Q150: Dana is considering investing $20,000 in one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents