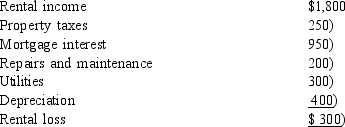

Jack and Cheryl own a cabin near Copper Mountain, Colorado. During the year, Jack and Cheryl rent the cabin for 30 days to friends for $1,800. Jack and Cheryl use the cabin a total of 60 days during the year. After making the appropriate allocation of planned expenses between personal and rental use, the following rental loss was determined:  How should Jack and Cheryl report the rental income and expenses for the forthcoming year? I. Only expenses up to the amount of $1,800 rental income may be deducted for the year. II. Only depreciation in the amount of $100 may be deducted. III. The amount of the disallowed depreciation deduction $300) can be carried forward. IV. Nothing needs to be reported.

How should Jack and Cheryl report the rental income and expenses for the forthcoming year? I. Only expenses up to the amount of $1,800 rental income may be deducted for the year. II. Only depreciation in the amount of $100 may be deducted. III. The amount of the disallowed depreciation deduction $300) can be carried forward. IV. Nothing needs to be reported.

A) Only statement I is correct.

B) Statements II and III are correct.

C) Statements I, II and III are correct.

D) Statements III and IV are correct.

E) Statements I, II, III, and IV.

Correct Answer:

Verified

Q65: Several factors are used to determine whether

Q80: Chelsea operates an illegal gambling enterprise out

Q81: Marlene is a single taxpayer with an

Q84: Karen owns a vacation home in Door

Q86: James rents his vacation home for 30

Q87: Mario paints landscape portraits, and he treats

Q88: Claire and Harry own a house on

Q89: Elise is a self-employed business consultant who

Q89: Mike and Pam own a cabin near

Q91: Generally income tax accounting methods are designed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents