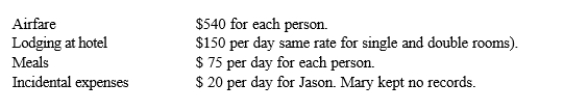

During 2014, Jason travels to Miami to meet with a client. While in Miami, he spends 2 days meeting with his client and 3 days sightseeing. Mary, his wife, goes with him and spends all 5 days sightseeing and shopping. The cost of the trip is as follows:  If Jason is self-employed, what is the amount of the deduction he may claim for the trip?

If Jason is self-employed, what is the amount of the deduction he may claim for the trip?

A) $ - 0 -

B) $ 415

C) $ 490

D) $ 955

E) $1,765

Correct Answer:

Verified

Q28: Carlotta pays $190 to fly from Santa

Q32: In 2014, Eileen, a self-employed nurse, drives

Q33: Julie travels to Mobile to meet with

Q34: During 2014, Marsha, an employee of G&H

Q36: Carter is a podiatrist in Minneapolis. He

Q37: Walker, an employee of Lakeview Corporation, drives

Q38: Lester uses his personal automobile in his

Q39: Arlene, a criminal defense attorney inherits $500,000

Q53: Entertainment,auto,travel,and gift expenses are subject to strict

Q55: Francine operates an advertising agency. To show

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents