Racer Industries is currently purchasing Part No. 76 from an outside supplier for $80 per unit. Because of supplier reliability problems, the company is considering producing the part internally in an idle manufacturing plant. Annual volume over the next six years is expected to total 300,000 units at variable manufacturing costs of $75 per unit.

Racer must acquire $80,000 of new equipment if it reopens the plant. The equipment has a six-year service life, a $14,000 salvage value, and will be depreciated by the straight-line method. Repairs and maintenance are expected to average $5,200 per year in years 4-6, and the equipment will be sold at the end of its life.

Required:

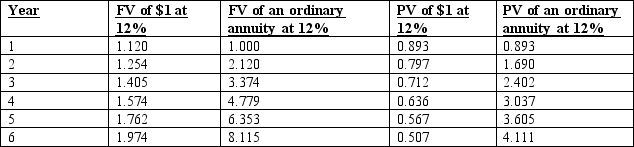

Rounding to the nearest dollar, use the net-present-value method (total-cost approach) and a 12% hurdle rate to determine whether Mark should make or buy Part No. 76. Ignore income taxes.

Correct Answer:

Verified

Q108: Randi Corp. is considering the replacement of

Q109: Kansas Corporation is reviewing an investment proposal

Q110: Both net present value (NPV) and the

Q111: Clear Skies Airline Company is planning a

Q112: On January 2, 20x1, Jennifer Grey purchased

Q114: Spear Company is considering a $5.4 million

Q115: Depreciation is often described as a "tax

Q116: Consider the five items that follow, which

Q117: Postaudits are an important part of capital

Q118: Warner Corporation is considering the acquisition of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents