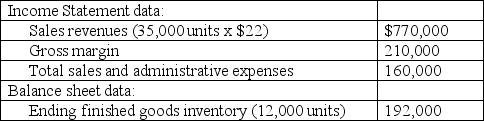

Carrington, Inc. began business at the start of the current year and maintains its accounting records on an absorption-cost basis. The following selected information appeared on the company's income statement and end-of-year balance sheet:

Carrington achieved its planned production level for the year. The company's fixed manufacturing overhead totaled $141,000, and the firm paid a 10% commission based on gross sales dollars to its sales force.

Required:

A. How many units did Carrington plan to produce during the year?

B. How much fixed manufacturing overhead did the company apply to each unit produced?

C. Compute Carrington's cost of goods sold.

D. How much variable cost did the company attach to each unit manufactured?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: What is a product's grade, as a

Q65: The following data relate to Santa Mia,

Q66: Craig Company has per-unit fixed and variable

Q67: Dalton Corporation has fixed manufacturing cost of

Q68: Absorption and variable costing are two different

Q69: The difference in income between absorption and

Q71: What is the difference between a product's

Q72: Take Two manufactures electrical switches for a

Q73: Xenon Enterprises (XE) produces two extruding machines

Q74: The following data relate to Jupiter Company,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents