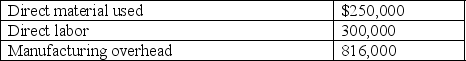

Altman Corporation uses a job-cost system and applies manufacturing overhead to products on the basis of machine hours. The company's accountant estimated that overhead and machine hours would total $800,000 and 50,000, respectively, for 20x1. Actual costs incurred follow.

The manufacturing overhead figure presented above excludes $27,000 of sales commissions incurred by the firm. An examination of job-cost records revealed that 18 jobs were sold during the year at a total cost of $2,960,000. These goods were sold to customers for $3,720,000. Actual machine hours worked totaled 51,500, and Altman adjusts under- or overapplied overhead at year-end to Cost of Goods Sold.

Required:

A. Determine the company's predetermined overhead application rate.

B. Determine the amount of under- or overapplied overhead at year-end. Be sure to indicate whether overhead was under- or overapplied.

C. Compute the company's adjusted cost of goods sold.

D. What alternative accounting treatment could the company have used at year-end to adjust for under- or overapplied overhead? Is the alternative that you suggested appropriate in this case? Why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Troski Corporation sells a number of products

Q85: Margin Call, Inc., which uses a job-costing

Q86: Pincus Corporation, which uses a job-costing system,

Q87: Farnham & Associates is a literary consulting

Q88: Layman, Inc., has just completed job nos.

Q90: Describe the types of manufacturing environments that

Q91: Farmington and Associates designs relatively small sports

Q92: Kwik Products uses a predetermined overhead application

Q93: Manufacturing overhead is applied to production.

A. Describe

Q94: Bonanza Enterprises provides consulting services and uses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents