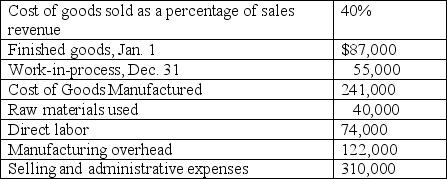

Sylvia Corporation sold 12,500 units of its single product during the year, reporting a cost of goods sold that totaled $250,000. A review of the company's accounting records disclosed the following information:

Sylvia is subject to a 30% income tax rate.

Required:

A. Determine the selling price per unit.

B. Management established a goal at the beginning of the year to reduce the company's investment in finished-goods inventory and work-in-process inventory.

1. Analyze cost of goods sold and determine if management's goal was achieved with respect to finished-goods inventory. Show computations.

2. Analyze the firm's manufacturing costs and determine if management's goal was achieved with respect to work-in-process inventory. Show computations.

C. Is the company profitable? Show calculations.

Correct Answer:

Verified

0.4X = $250,000...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Indirect costs:

A) can be traced to a

Q97: Costs that can be easily traced to

Q98: The fixed costs per unit are $10

Q99: The tuition that will be paid next

Q100: Which of the following would not be

Q102: In discussing the operation of her automobile,

Q103: Manufacturers have established a cost classification called

Q104: The Enrique Company recorded the following transactions

Q105: Miao Manufacturing, which began operations on January

Q106: Describe the economic characteristics of sunk costs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents