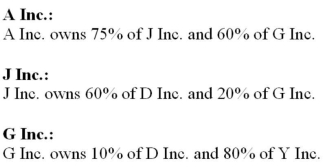

The following information pertains to the shareholdings of an affiliated group of companies. The respective ownership interest of each company is outlined below.  All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:

All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:  Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:

Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:  All companies are subject to a 25% tax rate. What is the Consolidated Net Income for the year attributable to the shareholders of A Inc.?

All companies are subject to a 25% tax rate. What is the Consolidated Net Income for the year attributable to the shareholders of A Inc.?

A) $1,510,000.

B) $1,796,125.

C) $1,817,500.

D) $2,170,000.

Correct Answer:

Verified

Q30: Whine purchased 80% of the outstanding voting

Q30: Assuming that A acquired a controlling interest

Q31: Q32: On January 1, 2012, Hanson Inc. purchased Q33: Whine purchased 80% of the outstanding voting Q35: The following information pertains to the shareholdings Q36: Whine purchased 80% of the outstanding voting Q37: Whine purchased 80% of the outstanding voting Q38: Whine purchased 80% of the outstanding voting Q39: ![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents