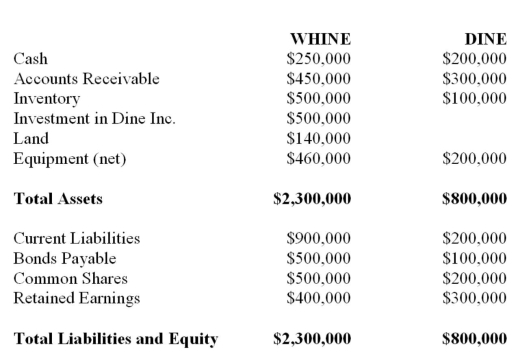

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2012. The Balance Sheets of both companies on that date are shown below (after Whine acquired the shares) :  Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. The amount of common shares appearing on the December 31, 2012 Consolidated Balance Sheet would be:

Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. The amount of common shares appearing on the December 31, 2012 Consolidated Balance Sheet would be:

A) $500,000.

B) $660,000.

C) $770,000.

D) $860,000.

Correct Answer:

Verified

Q23: Whine purchased 80% of the outstanding voting

Q24: Q25: Whine purchased 80% of the outstanding voting Q26: Q27: On January 1, 2012, Hanson Inc. purchased Q30: Assuming that A acquired a controlling interest Q30: Whine purchased 80% of the outstanding voting Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()