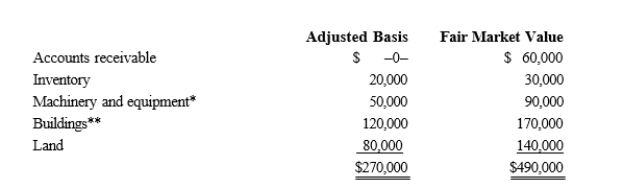

Kristine owns all of the stock of a C corporation which owns the following assets.  * Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

* Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

Correct Answer:

Verified

Q23: The profits of a business owned by

Q24: The special allocation opportunities that are available

Q26: An individual who owes the NIIT cannot

Q36: A shareholder's basis in the stock of

Q38: Mercedes owns a 30% interest in Magenta

Q41: Tuan and Ella are going to establish

Q47: Khalid contributes land fair market value of

Q49: Both Thu and Tuan own one-half of

Q57: Match the following statements.

-Sale of corporate stock

Q59: Match the following attributes with the different

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents